Table of Contents

Introduction

Africa’s digital commerce sector is entering a defining phase. By 2026, the continent’s online marketplaces are not only competing for consumers but also shaping logistics, payments, and digital trust. With smartphone penetration surpassing 50% and rapid improvements in digital infrastructure, platforms like Jumia, Takealot, Konga, Kilimall, and newer entrants such as Temu and Shein are transforming how Africans buy and sell goods. This guide offers a detailed look at the top online marketplaces in Africa — their models, growth drivers, and what makes each unique in a fast-evolving digital economy.

Overview & Comparison of Main Marketplaces

Africa’s e-commerce ecosystem remains fragmented but full of promise. Unlike Asia or Europe, where one or two giants dominate, Africa’s markets are highly localized. The leading platforms adapt to unique national conditions: low credit card usage, limited logistics infrastructure, and strong mobile payment adoption.

Key themes shaping the market in 2026 are:

- Mobile-first growth: Most transactions originate from mobile devices, particularly in Kenya, Nigeria, and Egypt.

- Payments innovation: Mobile money and fintech integrations — notably M-Pesa, OPay, and Flutterwave — are crucial for trust and convenience.

- Logistics evolution: Companies increasingly build or partner for last-mile delivery networks, a critical differentiator in markets with poor road infrastructure.

- Cross-border expansion: As trade within the African Continental Free Trade Area (AfCFTA) deepens, marketplaces are exploring regional logistics corridors and harmonized tax models.

| Marketplace | Active Markets | Core Model | Distinctive Edge | Challenges |

|---|---|---|---|---|

| Jumia | 9 countries | Marketplace + logistics + payments | First-mover, brand recognition, integrated delivery | Profitability, competition from global entrants |

| Takealot | South Africa | B2C & 3P marketplace | Strong logistics and warehousing | Domestic focus, limited regional reach |

| Konga | Nigeria | Marketplace & e-payments | Local ownership, hybrid online-offline retail | Scaling logistics network |

| Kilimall | Kenya, Uganda | Marketplace | Focused on affordability and regional sellers | Competes directly with Jumia |

| Shein / Temu (Africa entry) | Pan-African emerging | Cross-border D2C | Low prices, fast supply chain | Regulatory scrutiny, trust gap |

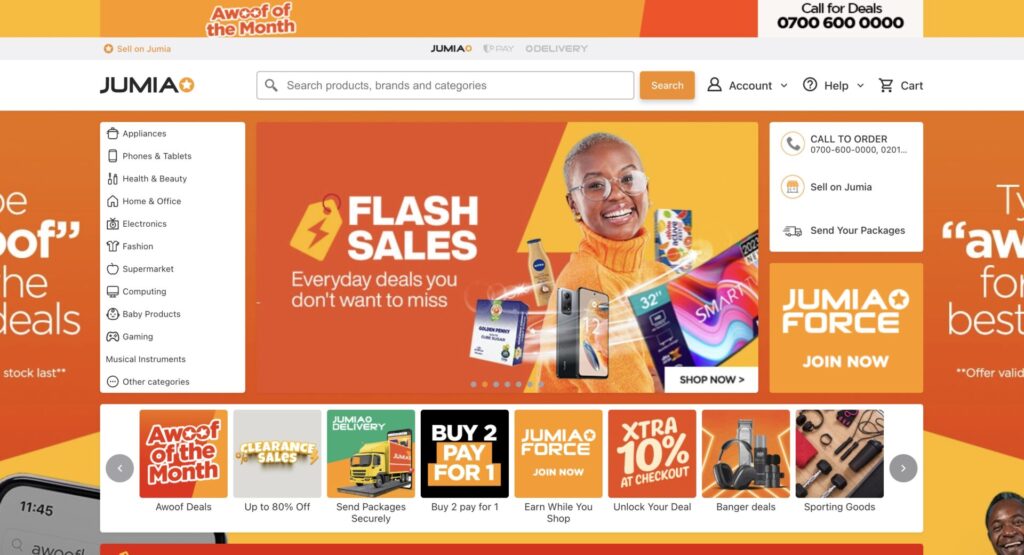

Jumia – Africa’s Pan-Continental Flagship

Jumia remains the most recognizable name in African e-commerce. Founded in 2012, it built its reputation as Africa’s “Amazon,” though its operational model differs significantly. Jumia combines three layers:

- Marketplace: Connecting over 100,000 active sellers with millions of consumers across 9 countries, including Nigeria, Egypt, Kenya, Morocco, and Côte d’Ivoire.

- Logistics: A network of warehouses, delivery hubs, and third-party partners allowing parcel delivery even in remote areas.

- Digital payments: JumiaPay, an in-house fintech service, processes transactions, offers bill payments, and increasingly supports merchants outside Jumia’s platform.

Market Position and Performance

According to recent reports, Jumia’s financial performance has stabilized after several years of losses. In 2025, its stock saw a remarkable surge of over 200%, driven by cost optimizations, reduced marketing spend, and improved order profitability. However, concerns remain over its ability to maintain scale while achieving consistent profitability across its diverse markets.

A key point of investor debate centers on whether Jumia’s structure — spanning logistics, payments, and marketplace — dilutes focus or provides a defensible moat. As Simply Wall St notes, while revenues are recovering, long-term value creation depends on Jumia’s ability to balance growth and efficiency.

Strategic Moves and Potential Acquisition

Recent reports from Modaes suggest that Jumia may be in talks for potential acquisition by Axian Telecom, a major African telecom operator. Such a move could make strategic sense: Axian’s connectivity infrastructure combined with Jumia’s e-commerce and fintech ecosystem would create a vertically integrated digital commerce platform — blending internet access, financial services, and retail under one umbrella.

This reflects a broader trend in African e-commerce: the convergence of telecoms, fintech, and retail. Telecom companies see e-commerce as a logical next step to deepen customer engagement and leverage payment ecosystems.

Competitive Pressures: Temu and Shein’s Entry

Jumia’s dominance is being tested by new global entrants. Platforms like Temu and Shein are making aggressive moves into Africa, offering ultra-low prices and free shipping. According to Reuters reporting, their expansion has pressured local players to revisit pricing strategies and logistics models. While these newcomers rely heavily on cross-border shipping from China, Jumia’s advantage lies in local presence — warehouses, delivery fleets, and brand familiarity with African consumers.

Outlook for Jumia in 2026

Jumia’s next growth phase will likely depend on three pillars:

- Deep fintech integration: Scaling JumiaPay beyond its marketplace to power third-party merchants.

- Efficiency in logistics: Leveraging AI-driven demand forecasting and route optimization to cut delivery costs.

- Partnership-driven expansion: Collaborating with telcos, fintechs, and governments to reach underbanked and rural consumers.

If the Axian deal materializes, Jumia could evolve from an e-commerce platform into a full-fledged digital infrastructure player for Africa — linking retail, finance, and connectivity in one ecosystem.

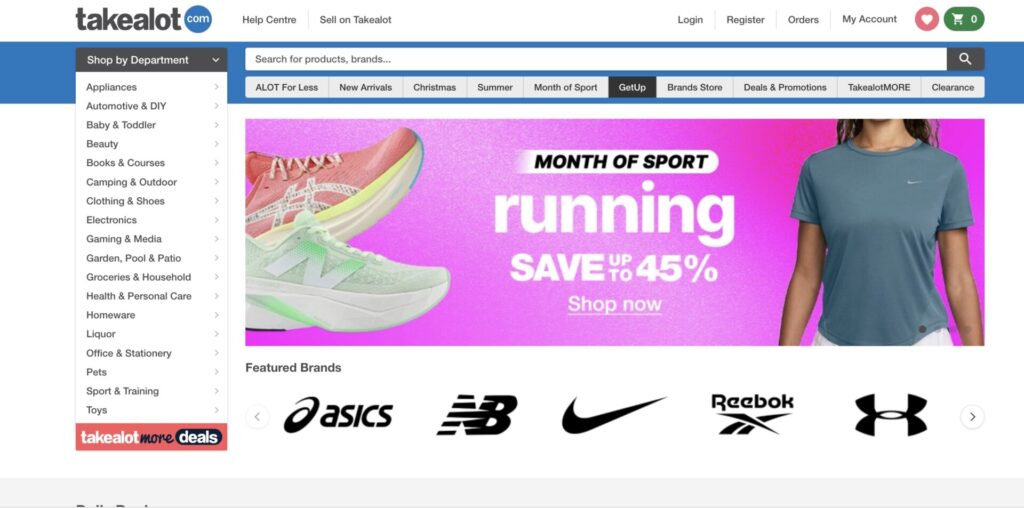

Takealot, South Africa

Takealot is South Africa’s category leader in online retail and marketplaces. In 2025 it began a visible pivot: partnering with government on skills and township inclusion, launching logistics-as-a-service, testing a mortgage comparison hub, relaunching B2B procurement, and scaling an on-demand convenience marketplace via Mr D. The strategy widens moats beyond retail by building rails in logistics, fintech-adjacent services, and talent pipelines.

Market Position and Performance

Takealot remains South Africa’s online retail anchor tenant. Independent research this September estimates online retail will top roughly R130 billion in 2025—about 10% of total retail— with Takealot still the most-used platform among local shoppers. In that same dataset, Takealot is used by ~31.9% of online shoppers, ahead of Amazon’s ~12.3%, while fast-fashion entrants (Shein/Temu) punch above their weight in apparel but face headwinds from tighter customs enforcement. The macro picture matters: growth has shifted from “pandemic spike” to structural adoption, especially in grocery and fashion, and Takealot’s job is to protect share while broadening use cases.

In parallel, Reuters reporting shows a company adapting to fiercer competition: overall sector growth is healthy, but Takealot’s team has admitted pockets of pressure and is pushing into townships and rural demand with personal shoppers, dark-store capacity, and new automation to keep fulfilment costs and lead times sharp.

Strategic Moves of Takealot

According to Reuters Takealot is betting big on same-day convenience by turning Mr D from “food only” into a broad on-demand marketplace. The platform now carries high-frequency non-food categories (e.g., toys, pet supplies) and aims over time for a 50:50 split between food and non-food deliveries, supported by retail brand partnerships that leverage Mr D’s last-mile. This is both offensive (capture incremental baskets) and defensive (blunt Uber Eats, Checkers Sixty60, Pick n Pay ASAP!, Amazon).

At the same time, the group carved out Takealot Fulfilment Solutions (TFS) as a standalone logistics business, opening its warehousing, courier, on-demand and international freight rails to third parties. Strategically, TFS externalises a core competence, chases B2B revenue, and strengthens the moat: the more merchants and brands that rely on its network, the stickier Takealot’s ecosystem becomes.

Public–Private Partnerships and Skills Pipeline

In September 2025, Takealot and South Africa’s Department of Higher Education and Training (DHET) signed a landmark MoU that knits the company’s logistics and platform know-how into the country’s skills engine. The agreement “adopts” three TVET/community colleges near Takealot distribution centres, expands a bursary programme with matched DHET funding, and uses Takealot’s network to distribute textbooks—while bringing SETAs on board to help township entrepreneurs list and trade online. It’s a real policy-meets-platform moment: building talent pipelines, opening digital market access for small businesses, and normalising e-commerce as a mainstream career path.

Diversification: B2B Procurement, Home Loans, and Subscriptions

Beyond retail and logistics, Takealot is probing adjacent profit pools. Takealot for Business relaunched as a single-supplier procurement doorway for everything from IT kit to catering—useful for SMEs that want less vendor sprawl and for corporates that want standardised buying rails. Home Loan Hub, built with MortgageMarket, lets shoppers compare bank offers in one place and run soft Experian checks—Takealot isn’t underwriting; it’s aggregating demand and monetising the application flow.

Outlook for Takelot in 2026

Baseline: South Africa’s online penetration is nudging 10%, and on-demand remains the growth engine. If Mr D’s category expansion sustains and TFS lands enough third-party volume, Takealot can grow GMV faster than the market while improving contribution margins via denser routes and better utilisation. Management-adjacent commentary suggests a push to reach breakeven at group level as early as 2026, helped by subscription stickiness and B2B/logistics revenue that is less promo-driven than consumer retail. The swing factors are clear: Amazon’s local cadence, apparel-import policy enforcement, grocery incumbents’ delivery economics, and South Africa’s load-shedding/interest-rate path. On balance, with policy tailwinds from the DHET partnership and a logistics-first operating thesis, 2026 looks like a year to consolidate leadership and normalise profitability—provided execution keeps last-mile costs in check and the non-food share on Mr D keeps rising.

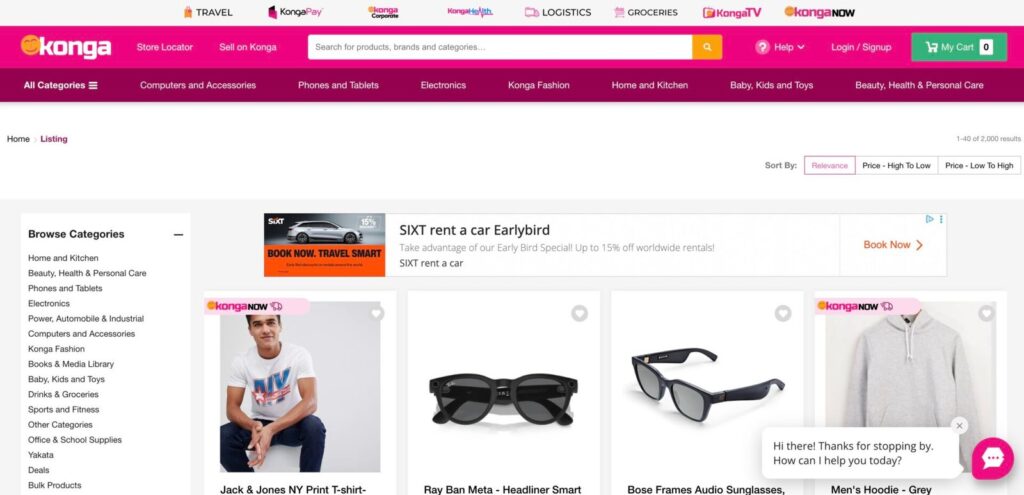

Konga, Nigeria

Konga sits in Nigeria’s top tier of multi-category marketplaces, trailing Jumia in overall scale but remaining a household name with strong brand recall and a durable shopper base. Recent local commentary pegs Nigeria’s e-commerce opportunity at $16bn+ by 2030, with Jumia and Konga named explicitly as core engines of that growth—a reminder that, while global entrants loom, the domestic pair still shapes the category narrative.

Discovery guides aimed at Nigerian consumers typically list Konga alongside Jumia as a default “general shopping” destination—often positioning Konga as the platform that blends online + offline retail due to its post-merger footprint and store presence. That omnichannel tag is important: in a market where delivery trust and payment frictions persist, a physical touchpoint can convert fence-sitters into repeat buyers.

Strategic Moves

Konga’s arc since 2018 has been deliberately infrastructure-first. Zinox Group acquired Konga and consolidated it with Yudala, rolling logistics (then KOS Express, now Konga Logistics) and payments (KongaPay) into a tighter stack. The logic: own the rails—warehousing, last-mile, and checkout—so unit economics aren’t hostage to third parties. Today, Konga Logistics markets nationwide delivery, B2B/B2C fulfilment, and API integrations for merchants; KongaPay remains the “one-tap” wallet layer designed to lower cart abandonment.

Konga Competitors in Nigeria

For Konga the competitive set is a three-body challenge:

• Jumia retains national leadership and is actively refocusing on core e-commerce, trimming loss-makers to push toward profitability—pressure Konga must match in customer experience and cost-to-serve.

• Jiji Nigeria dominates classifieds (cars, property, second-hand), siphoning high-ticket search intent away from traditional carts.

• Temu has entered Nigeria and is scaling ad spend and subsidies; yet long-run viability hinges on logistics costs and delivery reliability—where local incumbents’ feet-on-the-ground can still bite.

Operating Model: Logistics + Payments as the Moat

Nigeria’s e-commerce physics are dictated by logistics and trust. Konga’s in-house logistics arm markets nationwide door-to-door and merchant integrations, a play to compress delivery times, reduce failed deliveries, and keep fees predictable. Pairing this with KongaPay aims to solve the other friction: secure, low-friction payments that don’t scare off first-time buyers. In a market where many global challengers rely on third-party delivery networks, vertical integration is not a luxury; it’s survival math.

Brand, Omnichannel, and Events

The Zinox-Yudala consolidation left Konga with hybrid DNA: marketplace engine + offline retail heritage. That underwrites campaigns (anniversary “Yafun Yafun” sales) and store-adjacent activations that make the brand visible beyond screens—useful for onboarding late adopters and supporting returns/exchanges without eroding trust. Expect more of this “offline proof, online scale” posture to court SMEs and first-time shoppers

Outlook for Konga in 2026

Baseline expectation: Konga leans into disciplined growth—not land-grab theatrics. Three levers matter most:

- Reliability vs. subsidy — If Temu keeps discounting, Konga’s counter is consistent delivery + credible warranties, not a race to the bottom. Tekedia’s argument is blunt: logistics unit costs ultimately decide winners.

- Merchant enablement — More third-party brands onto Konga Logistics and KongaPay rails = higher take-rate resilience and better SKU breadth without ballooning inventory risk.

- Omnichannel trust — Offline touchpoints, BNPL/financing partners, and simplified returns can convert new cohorts as macro volatility tests consumer confidence.

On balance, with the $16bn-by-2030 tailwind and a rails-heavy operating thesis, 2026 should be about share defence + margin repair: shorter delivery SLAs in key metros, better prepaid penetration via KongaPay, and selective category pushes (phones, electronics, small appliances) where after-sales support differentiates. The wildcards are FX/Inflation, customs policy shifts, and the burn-rate of global challengers. If execution holds, Konga exits 2026 as Nigeria’s #2 full-stack marketplace—smaller than Jumia, but sturdier than subsidised tourists

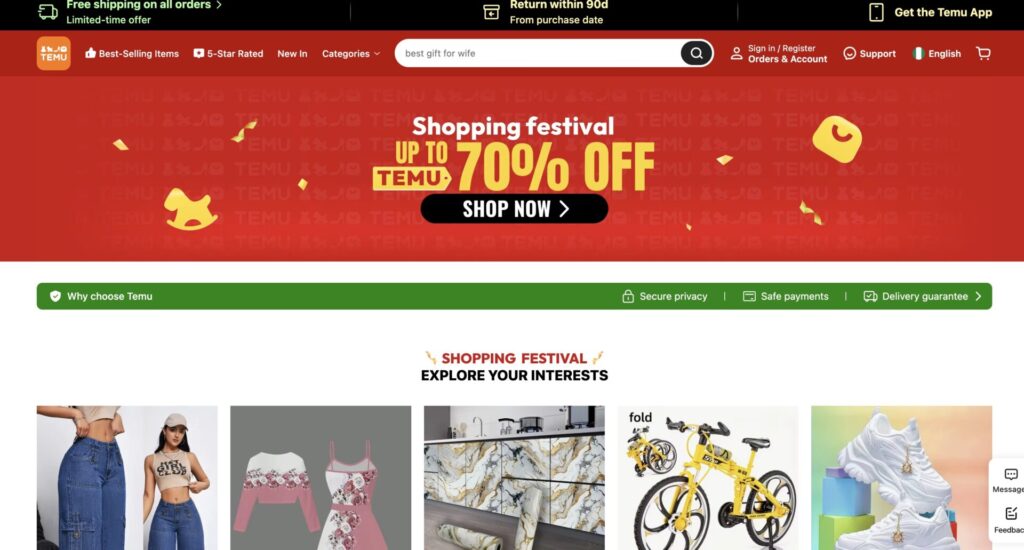

Temu in Africa

Temu’s Africa playbook mixes ultra-low pricing, high-octane ads, and increasingly local logistics. In 2024–2025 it accelerated in South Africa, formalised payments in Nigeria, and tested demand in other markets via cross-border shipping—pressuring incumbents and nudging regulators.

Market Position & Performance

In South Africa’s fashion market, Shein + Temu grabbed a combined 3.6% share (R7.3bn sales) by 2024, with Temu entering in 2024 and growing fast online; the CTFL e-commerce share reached ~37.1% for the duo. Surveys indicate roughly 1 in 3 South Africans have used Temu, with ~40% monthly actives among users.

Strategic Moves of Temu in Africa

- Local warehousing (SA): Temu now stocks “local warehouse” items in South Africa via 3PL partners, cutting delivery to sub-2 days for eligible SKUs—timed alongside SA’s move to close de-minimis tax loopholes. Techloy

- Payments localization (NG): Partnership with Verve unlocks naira card payments—key where foreign card rails are constrained. Broader global PSP tie-ups (e.g., Nuvei/PPRO) support future localization.

- Aggressive acquisition: App installs and discounting remain the engine; Jumia has responded by courting more China-based merchants.

South Africa – Temu’s African beachhead

Temu entered South Africa in 2024 and, alongside Shein, quickly carved out share in fashion e-commerce. By 2024 the duo captured 3.6% of the broader CTFL market (≈R7.3 bn sales), with Temu riding aggressive pricing and app-first acquisition. In 2025, online retail value in South Africa is projected to top $7 bn, lifting Temu’s ceiling as awareness and usage surge—surveys suggest roughly one in three South Africans has shopped on Temu.

In mid-2025 Temu introduced a “local warehouse” model via partners, tagging eligible SKUs for ~same-day to two-day delivery. This hybrid setup trims the long cross-border windows (often 4–22 business days), improves reliability on returns, and nudges repeat purchase behavior in a market that prizes speed and price.

Policy shifts have reshaped Temu’s cost stack: South Africa moved to end the small-parcel tax break and impose VAT on low-value imports, raising effective landed costs—one catalyst for Temu’s local-stock pivot. Competitive pressure is intense: Amazon launched locally in 2024 and keeps expanding, while Zando created an international unit to counter Temu/Shein; Takealot defends share with broad assortments and delivery infrastructure.

..